FAQs

How It Works

How does Kensington choose my investments?

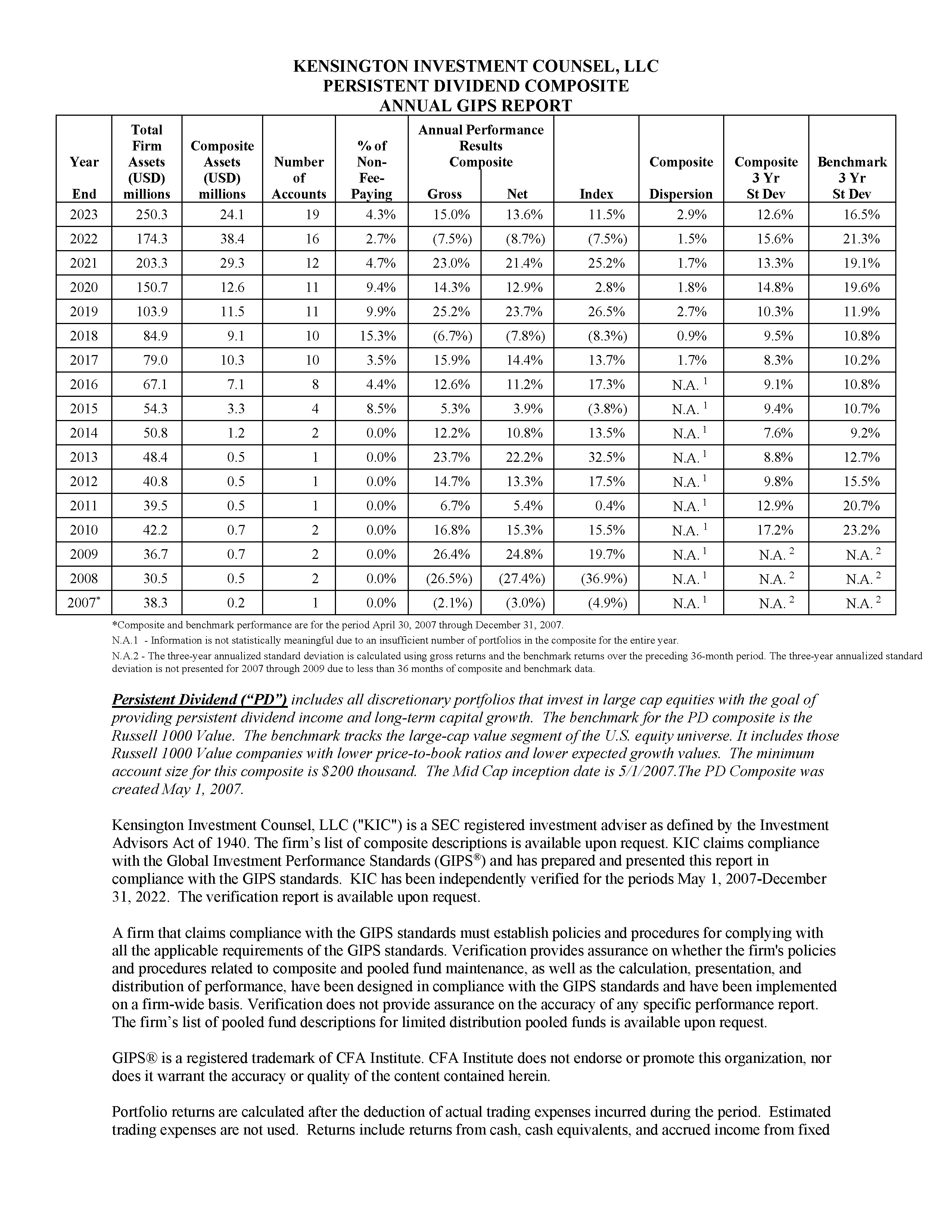

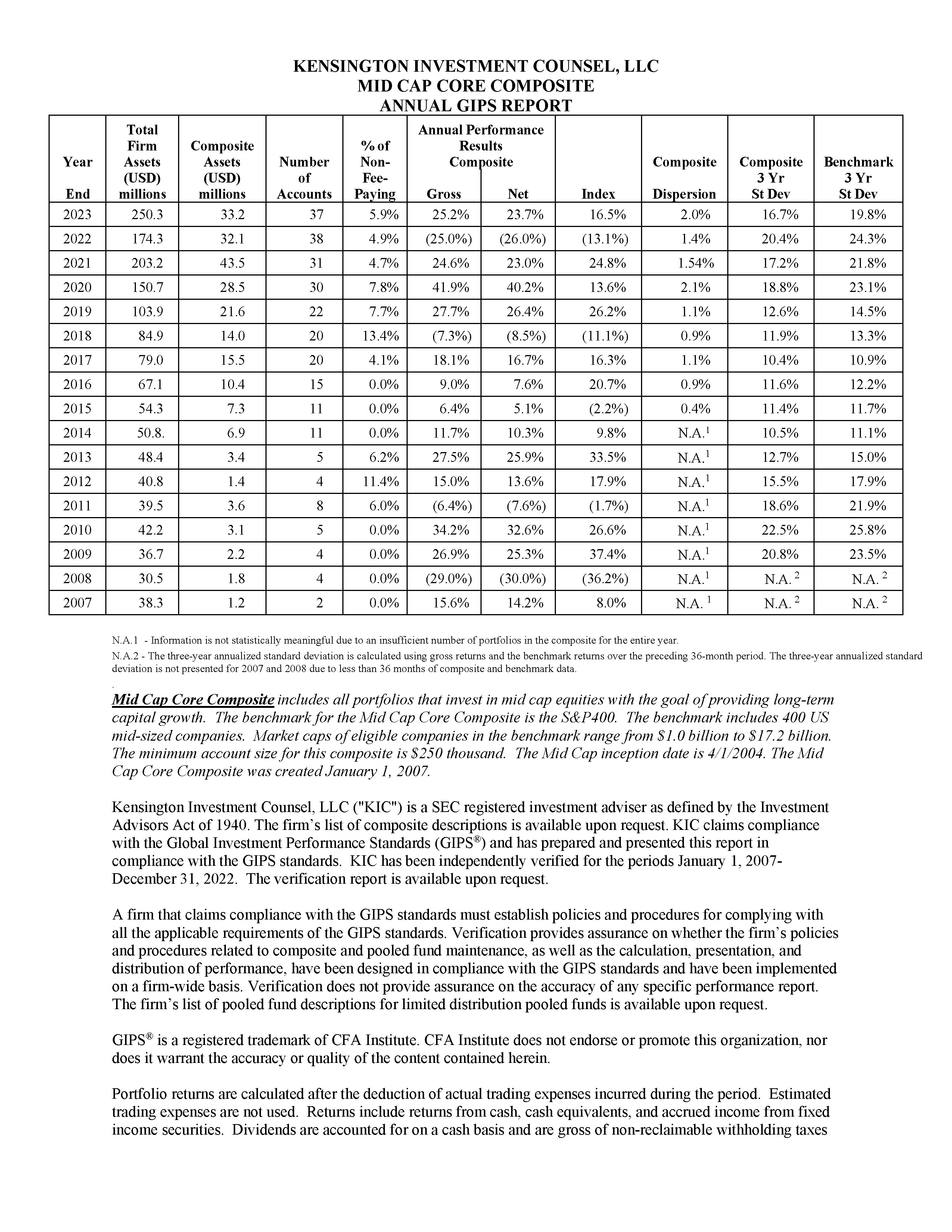

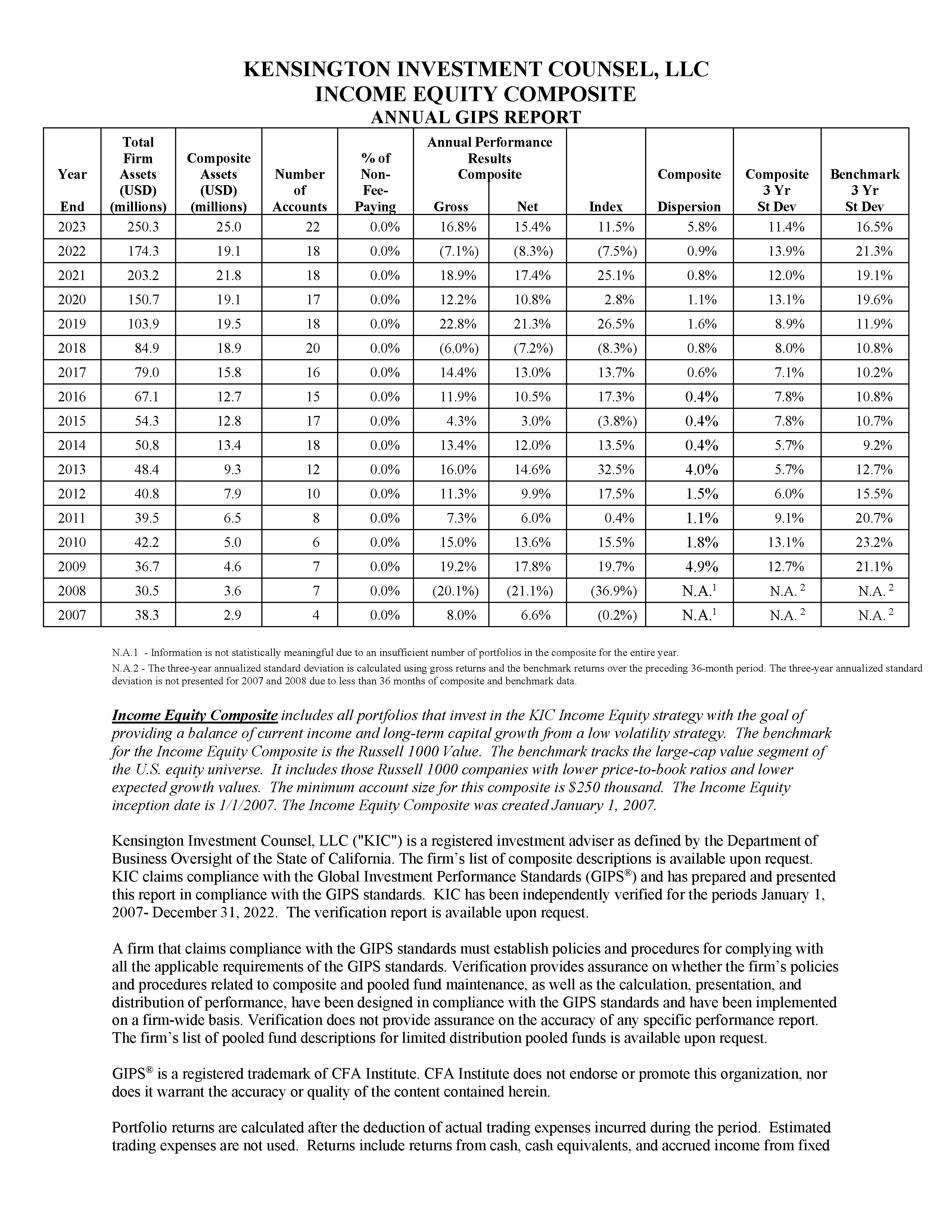

Kensington utilizes its own internally managed strategies and may combine these with select ETFs or mutual funds to create a customized portfolio tailored to your needs. Based on your risk tolerance and financial goals, Kensington crafts a personalized investment strategy designed to help you achieve your objectives. For more detailed information on each of our strategies, please refer to Kensington’s “GIPS Sheets” below.

How does Kensington trade my account?

Kensington places trades through Schwab to align your portfolio with the correct asset allocation based on your risk tolerance. Additionally, we periodically rebalance your portfolio to ensure proper diversification and to keep your investments in line with your goals.

How does Kensington handle proxy voting?

All KIC clients will have the option to vote their own proxies or select KIC to vote for them. If KIC is selected to vote the proxy, it shall be submitted electronically, and a record of the vote will be retained. It is the policy of KIC, as is our fiduciary obligation, to vote all proxies as per the best interests of our clients as shareholders of each company.

How often is my account reviewed?

Kensington regularly reviews client portfolios and rebalances them when necessary, based on market conditions and changes in your financial situation or risk tolerance. We also perform a full portfolio review at least annually.

Company Information

How does Kensington compare to other financial companies?

Unlike many financial firms, Kensington operates as a fiduciary. This means we are legally obligated to act in your best interest, putting your needs above our own. We must disclose any potential conflicts of interest, ensuring full transparency and fostering trust.

Who are the experts behind Kensington?

Our investment strategies and fund selections are guided by a team of experts, who have managed the portfolios for multiple decades.

What is your Mission Statement?

Our mission is to empower individuals to make the best financial decisions so they can live better lives. We aim to free our customers to pursue what is most meaningful to them and spend their time doing what they enjoy.

We manage money with the investment discipline we have refined over the 30 years since our founding. Our advice is tailored to your personal financial situation and the goals you aim to accomplish. We take care of everything for you, providing the rare opportunity to gain something invaluable: peace of mind.

What are Kensington’s core values?

Kensington believes in transparency, integrity, and fiduciary responsibility. Our core values center on putting our clients first and acting in their best interest at all times.

How is Kensington different?

Traditionally, managing money and investments has been a manual, time-consuming process, or has involved high fees for financial advisors and advanced strategies. Whether you are a first-time investor, a seasoned investor looking to improve, or a retiree aiming to make your nest egg last, Kensington offers an alternative to high advisor fees and the labor-intensive process of managing your investments.

Kensington’s portfolios are designed to achieve optimal returns at each risk level. We leverage a variety of strategies and technology to help investors retain as much of their returns as possible.

Financial Security

How do you keep my money safe?

Kensington only acts as the advisor on your account. By using Schwab as a custodian, we ensure that your assets are held with one of the most reputable and secure financial institutions. Schwab provides extensive protection measures including:

- SIPC Coverage: Schwab is a member of the Securities Investor Protection Corporation (SIPC), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash).

- Additional Protection: Beyond SIPC, Schwab provides additional protection through insurance policies for greater peace of mind.

- Advanced Security Measures: Schwab employs advanced technology and physical security measures to protect your information and assets from unauthorized access.

- Regulatory Oversight: Schwab is subject to rigorous regulatory oversight and audits to ensure compliance with industry standards and best practices.

- Transparent Reporting: You will receive regular, transparent account statements and have online access to monitor your account at any time.

What should I do if I suspect fraudulent activity in my account?

If you notice any suspicious or unauthorized activity in your account, please contact us immediately. We will work with Schwab to freeze your account and initiate an investigation to ensure your assets are secure.

How does Kensington protect against fraud?

Kensington and Schwab use industry-leading security measures, including multi-factor authentication, encrypted communications, and 24/7 account monitoring to detect and prevent fraudulent activity.

Can Kensington recover my account if it's compromised?

In the event of a security breach, Kensington and Schwab will work together to recover your account. This may involve locking your account, resetting credentials, and implementing additional security measures to prevent further access.

What precautions should I take to help protect my account?

We encourage clients to use strong, unique passwords and enable two-factor authentication on all accounts. Avoid sharing sensitive information via email and always report any suspicious activity or communication.

What are my options for managing a 401K?

Rolling over your 401k to an IRA is one of several options for your employer-sponsored retirement plan. Other options may include keeping your money in your existing 401k, transferring to a new employer’s plan, or taking a cash distribution. We recommend consulting a financial advisor to determine the best choice for your individual needs.

Getting Started

What are Kensington’s fees?

Kensington has two different levels of service for our investment offerings. Below we’ve listed a pricing breakdown according to account type and additional fee information.

- For 0.75% (75bps) per year you will gain access to Kensington’s Robo advisor. We call this our Robo plan because you receive our advice online. This plan is designed for investors who prefer a more hands-off approach with automated portfolio management and digital support. To be eligible for the robo offering, one must have a minimum of $50K

- We have a tiered fee schedule starting at 1.25% (125bps) for our full-service offering (this schedule is available in our ADV Part 2A). To be eligible for a full service offering, one must have a minimum of $500K. This plan includes personalized financial planning, dedicated advisor support, and comprehensive wealth management services tailored to your unique financial goals and needs.

Who is eligible for KIC Robo?

Kensington currently only operates in the United States, and for regulatory reasons cannot accept international customers residing outside the United States. Furthermore, for the time being only those wanting to roll their 401K into a Rollover IRA are eligible for Kensington’s Robo service.

How does Kensington provide client support?

Kensington provides client support through both our online platform and a dedicated client service team. Support is available via our website, email, and phone, ensuring that you can get assistance when you need it.

What if I need help choosing the right plan?

If you’re uncertain about which plan is best for you, our advisory team can provide a consultation to guide you based on your specific needs and financial goals.

Can I transfer my existing accounts to Kensington?

Yes, you can transfer most types of investment accounts to Kensington’s management, including IRAs, trusts, and taxable accounts. While our robo-advisor feature currently only accepts retirement accounts, if you have $500,000 or more in assets, you are eligible for our full-service offering, which accommodates a broader range of account types

How do I transfer my existing assets to Kensington?

Transferring your assets to Kensington is simple. Schwab, our custodian, will handle the transfer process, ensuring that your assets move over smoothly from your current accounts, whether they are IRAs, 401Ks, or taxable accounts. Our team will guide you through completing the required paperwork, and Schwab will ensure that the transfer happens without triggering any taxable events. Once the transfer is complete, Kensington will align your portfolio with your financial goals.

Managing My Account

What accounts can I open with KIC Robo?

For the time being you can only open Rollover IRAs with the Kensington Robo advisor. Note that most IRAs as well as 401Ks can be converted into your Rollover IRA.

Where can I find my account statements?

Since Kensington uses Schwab as its custodian, your account statements will be available on Schwab’s website under the documents tab. You will also receive an electronic statement via Kensington’s Black Diamond Wealth Platform. You will receive a statement each month on each platform.

How do I update my investment preferences or personal information?

You can update your personal information directly through Schwab. If you wish to modify your investment preferences or financial goals, please contact our advisory team, and we will work with you to determine the most appropriate adjustments for your portfolio.

How can I monitor my portfolio's performance?

You can track your portfolio’s performance through both the Schwab platform and Kensington’s portal on Black Diamond Wealth Platform, which provide detailed performance reports and analytics. Additionally, you will receive regular statements through Schwab.

How do I withdraw money from my account?

You can initiate withdrawals directly through Schwab. Depending on the type of account you hold, there may be tax implications or penalties for early withdrawals. We recommend consulting with our advisors before making any significant withdrawals to understand the potential impact.

If you are required to take RMDs, Schwab allows you to manage and set them up through their platform. You can choose a schedule for your distributions—whether you prefer monthly, quarterly, or annual withdrawals. Schwab’s automated RMD service will calculate your required distribution for the year and process it according to your chosen schedule. Our advisors can help guide you through this process and ensure you meet your RMD requirements to avoid penalties.

What are my options if I don’t want to roll over my 401K into a Rollover IRA?

If you’re unsure about rolling over your 401K into a Rollover IRA, you have other options, such as leaving the 401K with your former employer, transferring it to a new employer’s plan, or cashing it out (though this could lead to taxes and penalties). Each option comes with its own benefits and drawbacks, so it’s important to carefully assess which choice best aligns with your financial goals and circumstances